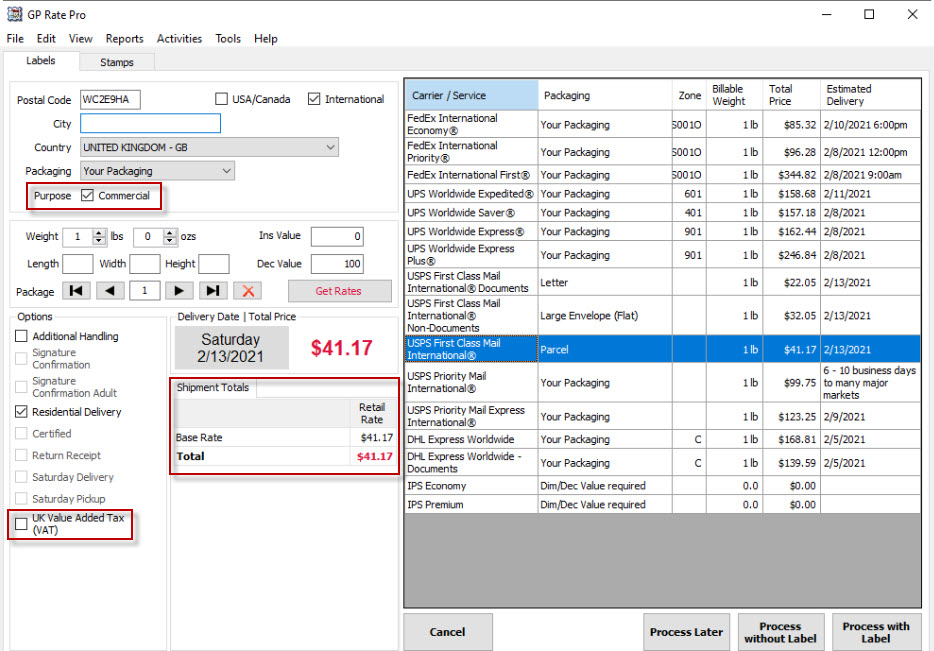

- Put destination.

- Make sure Box Purpose Commercial is checked.

- Put dimensions and declared value.

- Pay attention to the Options Section. UK Value Added Tax (VAT) box should be unchecked.

- UK VAT rate is will not be shown in the Shipment Totals section. This amount is paid by 3rd party.

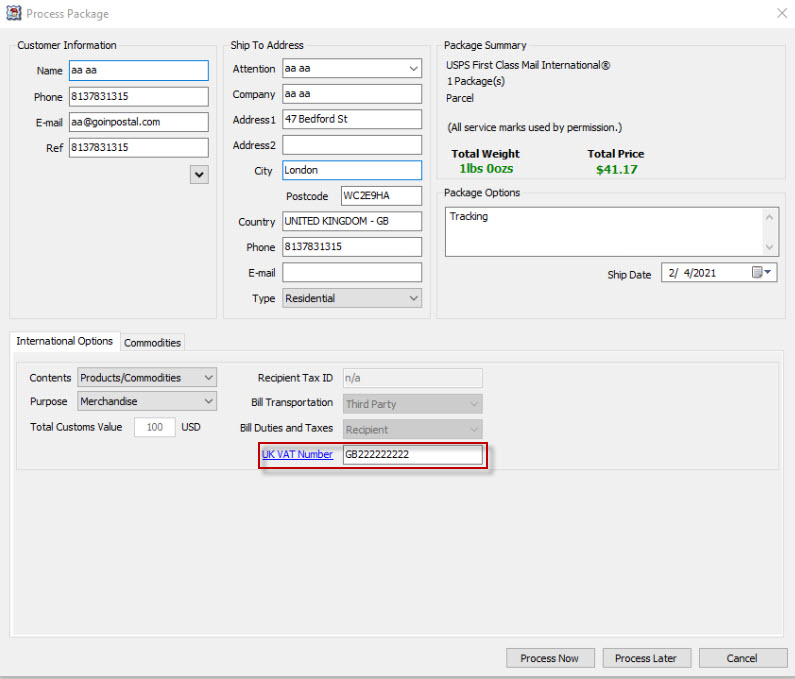

6. Enter UK VAT Number that your customer provides in the UK VAT Number field in the International Options section of the Process Package window. For more information on shipping commercial packages to UK in 2021, click on the blue link UK VAT Number.